Zakat with PA USA

Your Zakat can fuel positive change by providing nutritious meals for families, orphan sponsorship, water wells, and more.

All Penny Appeal USA programs are Zakat-eligible

Zakat is an annual charitable payment that goes on to benefit those in need and is a Religious obligation for Muslims everywhere. Your Zakat is a beautiful pillar of Islam that allows you to care for orphans and the elderly, provide food and water, deliver healthcare and education, or even provide emergency aid to those struck by disaster.

Read Our Zakat Policy

- All Zakat donations received by Penny Appeal USA are internally tagged as Zakat for use exclusively for Zakat-eligible programs.

- When a Zakat donation is designated to a certain program by a donor, this restriction will be respected and the funds are used solely for the donor’s intended purpose to the greatest extent possible, unless doing so becomes impossible due to unforeseen external circumstances.

- When a Zakat donation is not designated to a specific program by the donor, Penny Appeal USA allocates the funds according to the eight categories of Zakat-eligible programs as outlined in the Quran (see below). Note that Penny Appeal USA strongly encourages donors to make their donations unrestricted, providing us greater flexibility to respond to urgent needs.

- Zakat-eligible projects are identified based on need and per the eight categories noted in the Quran (9:60):

- ‘al fuqara’ (the poor)

- ‘al masakin’ (the chronically needy / indigent)

- ‘al amilina alayha’ (the administrators of Zakat funds)

- ‘al mualafati qulubhum’ (those that incline their hearts towards good)

- ‘f’il riqabi’ (freeing of slaves / those in bondage)

- ‘al gharimina’ (those in debt)

- ‘f’il sabili-llahi’ (in the way of God)

- ‘al sabili’ (the traveler)

- In line with category C (“the administrators of Zakat funds”), a portion of Zakat funds collected are eligible to be allocated toward covering operational costs which enables us to ensure impactful distribution and monitoring of funds (such as gasoline for delivery vehicles, salaries for monitoring staff, and accounting fees for financial oversight). Some organizations feel pressured to publicly advertise unsustainably low – or even 0% – overhead numbers for their Zakat, or to promote the widely held, although jurisprudentially non-binding, perspective that a 12.5% allocation for pure administration is an acceptable level. We recognize that providing high-quality, impactful programming at a significant scale in the long term requires regular investments in professional staff, technology, marketing, and training, especially given that our programming takes place in some of the most challenging operating environments in the world (Afghanistan, Gaza, Yemen, Somalia, and Syria, among others). We therefore endeavor to keep our spending on administration for incoming program designated Zakat donations, at all times, as low as responsibly possible, never exceeding 12.5%. Kindly let us know if you would like to support the overhead cost so we never have to use any Zakat donation to support the operations.

- Penny Appeal USA agrees with the position that Zakat donations are intended for distribution as immediately as is feasible, rather than for accumulation by the distributor. As such, we make every possible effort to disburse Zakat funds as rapidly as possible, intending to not do so later than within one calendar year of their collection.

GIVE YOUR ZAKAT

GENERAL DONATIONS

Your Zakat can provide emergency aid, bring nutritious meals to families, sponsor orphans, build wells, and more!

Hygiene Kits for $150/month

Give 2 hygiene kits to families impacted by natural or man-made disasters.

A Water Well for $300/month

Show someone you love how much you care by building a well in their honor.

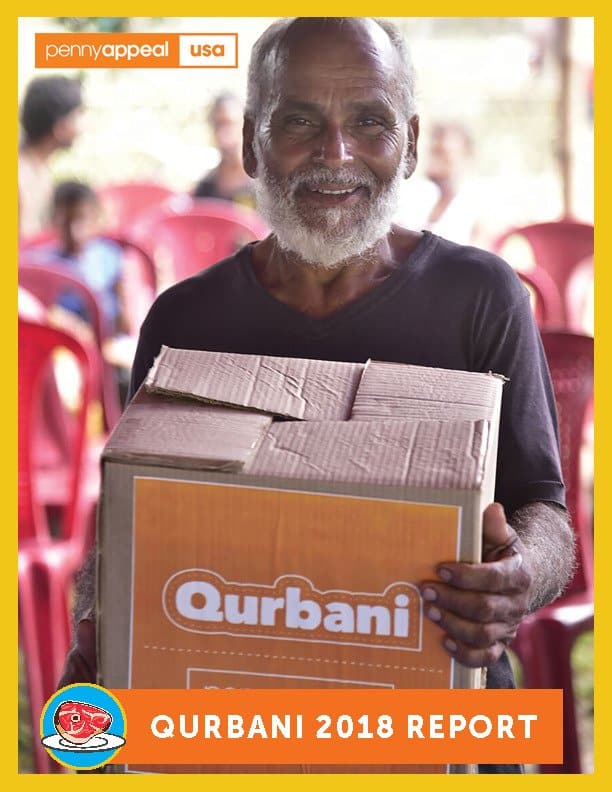

ORPHANKIND

Sponsor 10 Orphans for $300/month

Provide nutritious meals, clothes, healthcare and an education to orphaned children in over eight countries.

Other Religious Giving

$12 per Family Member

Fitrana is due on every member of a household, including any children or elderly persons before eid prayer.

One Day of Food for $15

For fasts missed through ill health or pregnancy, which cannot be made up afterwards for legitimate reasons, give Fidyah.

30 Meals for $50

If fasts are broken without allowable reasons, and the compensatory two months of fasting is not possible, then give Kaffarah.

Automate your giving with MyTenNights.

We’ve partnered with MyTenNights to help you automate your giving during the last ten nights of Ramadan. By automating your donations and zakat, you don’t have to go online every night and donate.

Support Penny Appeal USA on LaunchGood

Set Love In Motion with Penny Appeal USA this Ramadan by feeding the hungry, building wells, and sponsoring orphans or creating your own fundraiser for a Penny Appeal USA cause!

Download our Zakat Guide!

Zakat FAQs

If you have any more questions, please feel free to chat with our team.

In Arabic, zakat means purification, growth and blessing. It is a charitable practice that requires all able Muslims (those who meet the requirement of zakat as dependent upon nisab and hawl—see below) to contribute a fixed portion of their wealth – 2.5% of savings — to help the needy.

Zakat is not only a means to purify one’s wealth but it is also a spiritual purification which serves as a means to draw an individual closer to God. As one of the scholars said, “the soul of one who gives zakat is blessed and so is his wealth”. It is quite clear from the above narration that in addition to being a moral obligation, Zakat is also a spiritual one which is why millions of Muslims every year give Zakat to the poor.

'In their wealth there is a known share for the beggars and the destitute.’ (70:24-25)

Nisab is the minimum amount of wealth a Muslim must have—after calculating necessary expenses—to be eligible to contribute zakat. The nisab is determined by the current value of gold or silver. While some scholars encourage everyone to use the silver nisab value because it is the safest opinion and increases charity for those in need, it is ultimately up to the Zakat giver to determine which value they prefer to use. The majority today use the gold nisab equivalent.

Nisab is equivalent to the current value of 3 ounces of gold or 21 ounces of silver. The nisab we’ve calculated for our Zakat Calculator is based on the most-recent report available to us (disclaimer: this number may change daily depending on fluctuations in the gold exchange rate).

For a detailed list of wealth to include, please see our Zakat Calculator

These stipulations delineate the type of wealth that should be accounted for when calculating zakat:

The wealth is yours and under your control. You do not need to include outstanding debts when calculating zakat.

The wealth is subject to development and increasing.

After calculating necessary expenses, the wealth meets the requirements of nisab.

Personal belongings, such as clothes, primary homes, food, cars, are exempt from zakat.

You may make your zakat contributions toward any of our funds or projects. It is your intention that counts in this case. However, if your contribution is specifically made to our Zakat Fund then we will follow specific zakat guidelines.

Zakat-eligible projects are identified based upon need and in accordance with the eight categories noted in the holy Quran:

- ‘al fuqara' (the poor)

- ‘al masakin’ (the chronically needy / indigent)

- ‘al amilina alayha' (the administrators of zakat funds)

- ‘al mualafati qulubhum’ (those that incline their hearts towards good)

- 'f’il riqabi' (freeing of slaves / those in bondage)

- ‘al gharimina' (those in debt)

- 'f’il sabili-llahi' (in the way of god)

- ‘al sabili' (the traveller)

Yes. You may use the current value on stocks.

Zakat al-Mal (commonly called “zakat“) is due when a person’s wealth reaches the nisab amount and can be paid anytime during the year. Zakat al-Fitr is paid by the head of the household for each member of the family, before Eid al-Fitr prayer. Zakat al-Fitr is about the price of one meal—estimated at $10 in 2021.

Zakat al-Fitr should be paid on behalf of everyone in the family. There are some scholars that recommend that Zakat al-Fitr is also paid on behalf of unborn children after the 120th day of pregnancy, but do not view it as obligatory. Most scholars do agree, however, that Zakat al-Fitr should be paid on behalf of the baby after his/her birth. Please do consult with your local imam or scholar for further clarification.

It should be paid before Eid prayer (or any day during Ramadan). There are some schools of thought that also allow for Zakat al-Fitr to be paid even before Ramadan. Consult with your local imam or scholar if you need additional information.

Give Your Zakat with Penny Appeal USA

Transform Lives with Your Zakat

Your Zakat fuels change. At Penny Appeal USA, all of our programs are zakat-eligible. That means your zakat can bring nutritious meals to families, sponsor an orphan, provide a well, and more!

Donate your Zakat to any of our Zakat-eligible appeals today:

Education First

Feed Our World

Thirst Relief

Emergency Response

Income Generation

OUR IMPACT